Financial assistance for SMEs & extension of time for statutory filings due to Covid-19 Outbreak

- tapartnerskl

- Mar 28, 2020

- 4 min read

Updated: Mar 31, 2020

Following the announcement of Movement Control Order (“MCO”), all government and private premises except those involved in essential services (eg. financial, electricity, public health etc.) shall be closed for 14 days from 18th March 2020 to 31st March 2020 and it has now been extended for another 14 days to 14th April 2020.

To assist businesses and households affected by the COVID-19 outbreak and the MCO, government agencies have announced various measures and extension program as follows:

INLAND REVENUE BOARD (“IRB”) – EXTENSION OF DEADLINE AND PROMOTING INVESTMENTS

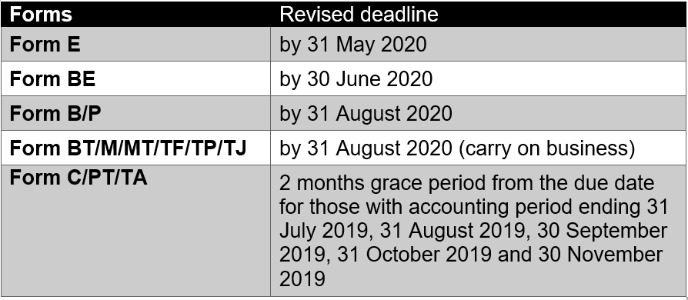

IRB announced that the last day to file the various income tax return forms for year 2019 has been extended by two months from the original deadline as follows:

IRB has also announced the deferment of monthly tax installments from 1 April to 30 September 2020 for tourism industry such as travel agencies, hoteliers and airlines. While for all Small Medium Enterprises (SMEs), there is deferment of income tax installments payment for a period of three (3) months starting from 1 April 2020.

To encourage businesses to invest in capital expenditures, annual allowance for qualifying capital expenditure on machinery and equipment including ICT equipment which incurred from 1 March 2020 to 31 December 2020 is increased to 40%. Businesses that carry out renovation and refurbishment from 1 March 2020 to 31 December 2020 on their business premise will be given tax deduction up to RM300,000.

JABATAN KASTAM DIRAJA MALAYSIA (“JKDM”) – EXTENSION OF DEADLINE

JKDM also announced that the submission and payment deadline for January 2020 to February 2020 return which falls on 31st March 2020 has been extended to 30th April 2020 and no penalty will be imposed for payment made on or before 30th April 2020.

COMPANIES COMMISSION OF MALAYSIA (“SSM”) AND SECURITIES COMMISSION (“SC”)

Listed corporations which may only hold their AGMs beyond the prescribed 6-month period as stipulated under the Companies Act 2016 can apply to defer their AGMs with the SSM. Please refer to FAQ published by SSM AGMs filing during MCO period.

In addition, the SC has granted a two-month extension for REITs managers of listed REITs with a financial year-end of 31 December 2019 to hold AGMs by 30 June 2020. One-month extension for issuance of quarterly report and annual reports (“reports”) has also been granted to listed issuer for reports which are due by 31 March 2020. Listed issuer who may face difficulties in meeting prescribed time frame to issue its financial statements may apply for extension of time.

BANK NEGARA MALAYSIA - FINANCIAL ASSISTANCE

Bank Negara Malaysia (‘BNM’) has allocated billions of financing facilities for SMEs which aims to ease SMEs’ short-term cash flow problems and help SMEs in sustaining their business operations during this period. SME definition by SME Corp, with at least 51% shares held by Malaysians.

Financing facilities offered to SMEs are as follows:

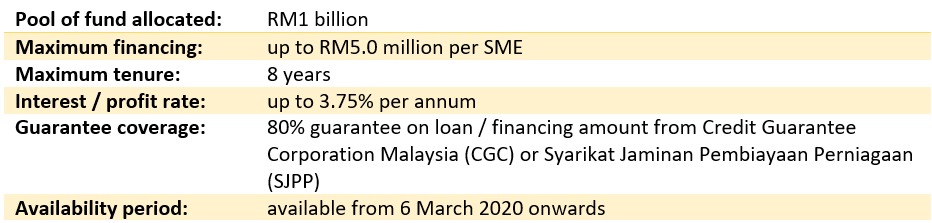

Special Relief Facility (SRF)

Features are as follows:

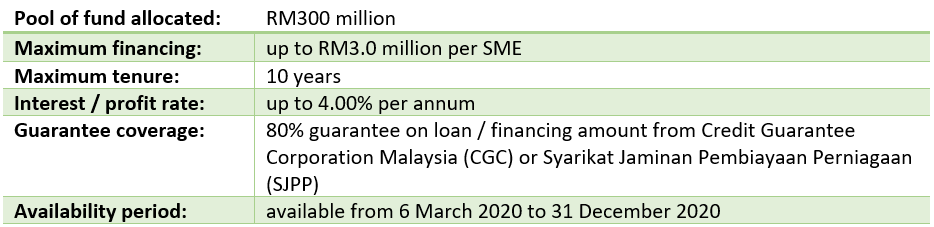

Agrofood Facility (AF)

Features are as follows:

Automation and Digitalisation Facility (ADF)

Features are as follows:

The availability period is also subject to exhaustion of the allocated fund, whichever is earlier. Interested SMEs can apply directly to participating financial institutions which comprise commercial banks, Islamic banks and development financial institutions regulated by BNM. SMEs may also apply online through the business financing referral platform at imsme.com.my.

Moratorium on repayment/payment of loans/financing

To ease the cash flow of SMEs and individuals that are affected, banking institutions will grant an automatic moratorium on all loan/financing repayments/payments, principal and interest, (except for credit card balances) by individuals and SME borrowers/customers for a period of 6 months from 1 April 2020. The automatic moratorium is applicable to loans/financing that are:

(a) not in arrears exceeding 90 days as at 1 April 2020; and

(b) denominated in Malaysian Ringgit.

During this period, borrowers/customers with loan/financing that meet the conditions do not need to make any repayment, and no late payment charges or penalties will be imposed. Interest/profit will continue to accrue on loan/financing repayments that are deferred and borrowers/customers will need to honour the deferred repayments in the future. Loan/financing repayment resumes after the deferment period. SMEs and individuals that do not wish to avail themselves to the automatic moratorium can opt-out of the automatic deferment package.

For outstanding credit card balances, banking institutions shall offer borrowers/customers the option to convert their credit card balances into a term loan/financing of a tenure of not more than 3 years and an effective interest/profit rate of not more than 13% per annum. For individuals who have demonstrated signs of repayment/payment difficulty (i.e. unable to meet the minimum monthly repayment for the last 3 consecutive months), banking institutions shall automatically convert their credit card balances into term loans.

Due to the fast changing updates from various government agencies from time-to-time, we urge you to visit the official websites or call the respective government agencies/ financial institution for the latest information/ updates.

Hope the above information give you some insights and help to clear some of your doubts!

+6011 - 3501 6778+6011 - 3501 6778

For more information or enquiries, please email us @ ta.partner.kl@gmail.com or audit@ta-partnersplt.com / Whatsapp us @ +6011-35016778 / Call Mr. Toon @ +603-77331688 (Business hours: 8.30 - 5.30pm only)

Comments